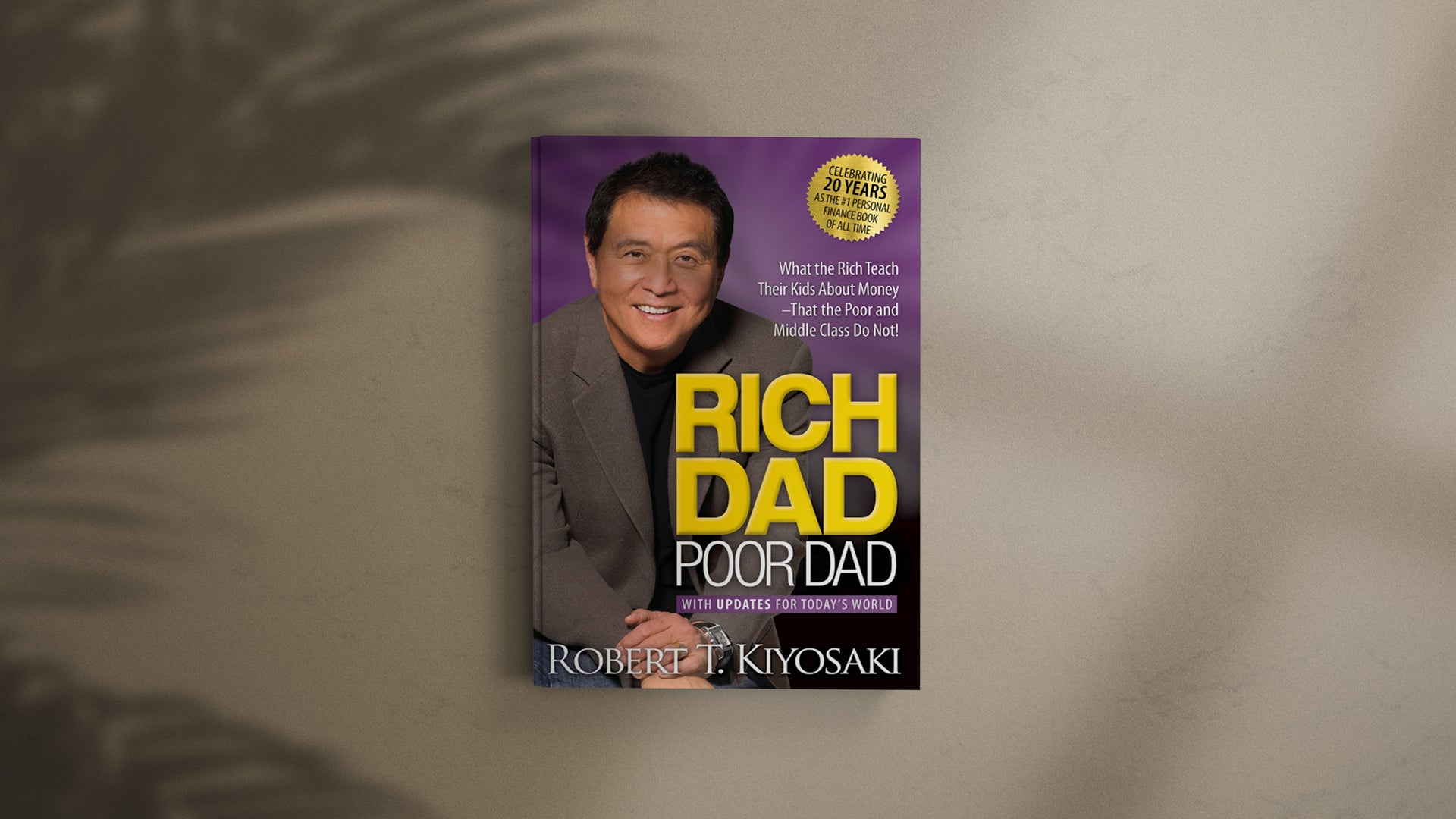

Have you ever come across a book that completely shifts your perspective on money and wealth? Well, ‘Rich Dad Poor Dad’ by Robert Kiyosaki is one such book that has taken the world by storm.

Let’s explore the content of the book, why it’s created such a buzz, and most importantly, what valuable lessons it can teach us. Through its powerful insights on financial literacy and mindset, “Rich Dad Poor Dad” empowers us to take control of our financial future and build a path to prosperity.

‘Rich Dad Poor Dad’ challenges the conventional wisdom surrounding money and wealth. It introduces us to two influential father figures – the “poor dad” and the “rich dad.” The “poor dad” emphasizes the importance of working for money, while the “rich dad” highlights the significance of making money work for you. It challenges our beliefs about traditional employment and sparks the question.

Are we working to build wealth or just to pay the bills?

As an entrepreneur, you have the opportunity to build your own wealth and create a sustainable income by using your skills, ideas, and resources. Instead of solely relying on a paycheck.

Financial literacy is a main concept of “Rich Dad Poor Dad.” It educates us about the difference between assets and liabilities, teaching us to focus on acquiring income-generating assets rather than accumulating liabilities. As Kiyosaki says, “The rich focus on their asset columns while everyone else focuses on their income statements.” This shift in perspective is crucial for building lasting wealth.

In simpler terms, “Rich Dad Poor Dad” teaches us to be smart with our money. It encourages us to invest wisely, save for the future, and build a strong financial foundation. By focusing on income-generating assets, we can create a pathway to financial success and build lasting wealth for ourselves and future generations.

In the book, Kiyosaki introduces the concept of the “rat race” the endless cycle of working for money without truly getting ahead. He encourages us to think beyond a traditional job and explore opportunities to generate passive income.

Dear readers, Do we want to spend our lives working for someone else’s dream or create our own path to financial freedom. Think about it?

Fear of failure often holds us back from taking risks, but Kiyosaki challenges this mindset. He reminds us that successful people embrace failure as a learning opportunity and take calculated risks to achieve their goals. As he famously says, “Winners are not afraid of losing. But losers are. Failure is part of the process of success.”

One of the most inspiring aspects of “Rich Dad Poor Dad” is its focus on creating a legacy of wealth. Kiyosaki stresses the importance of building assets that will provide for future generations. By developing a strong financial foundation, we can leave a lasting impact and pass on a legacy of financial security to our loved ones.

The idea behind creating a legacy of wealth is to shift from a short-term mindset focused solely on personal financial gain to a long-term perspective that encompasses generational wealth and impact. It means thinking beyond immediate success and considering the long-lasting effects of your entrepreneurial endeavors.

As you embark on your journey towards financial success, remember the lessons from “Rich Dad Poor Dad.” Shift your mindset, focus on acquiring income generating assets, and build a strong financial foundation. Embrace failure as a stepping stone to success, take calculated risks, and create a legacy of wealth that will benefit not only yourself but also future generations.